Tax deductions are expenses that you can deduct from your total income to reduce your taxable income. This means that the more deductions you have, the less you will owe in taxes. Common deductions include mortgage interest, student loan interest, and certain medical expenses. Understanding which deductions you qualify for can help you save money during tax season.

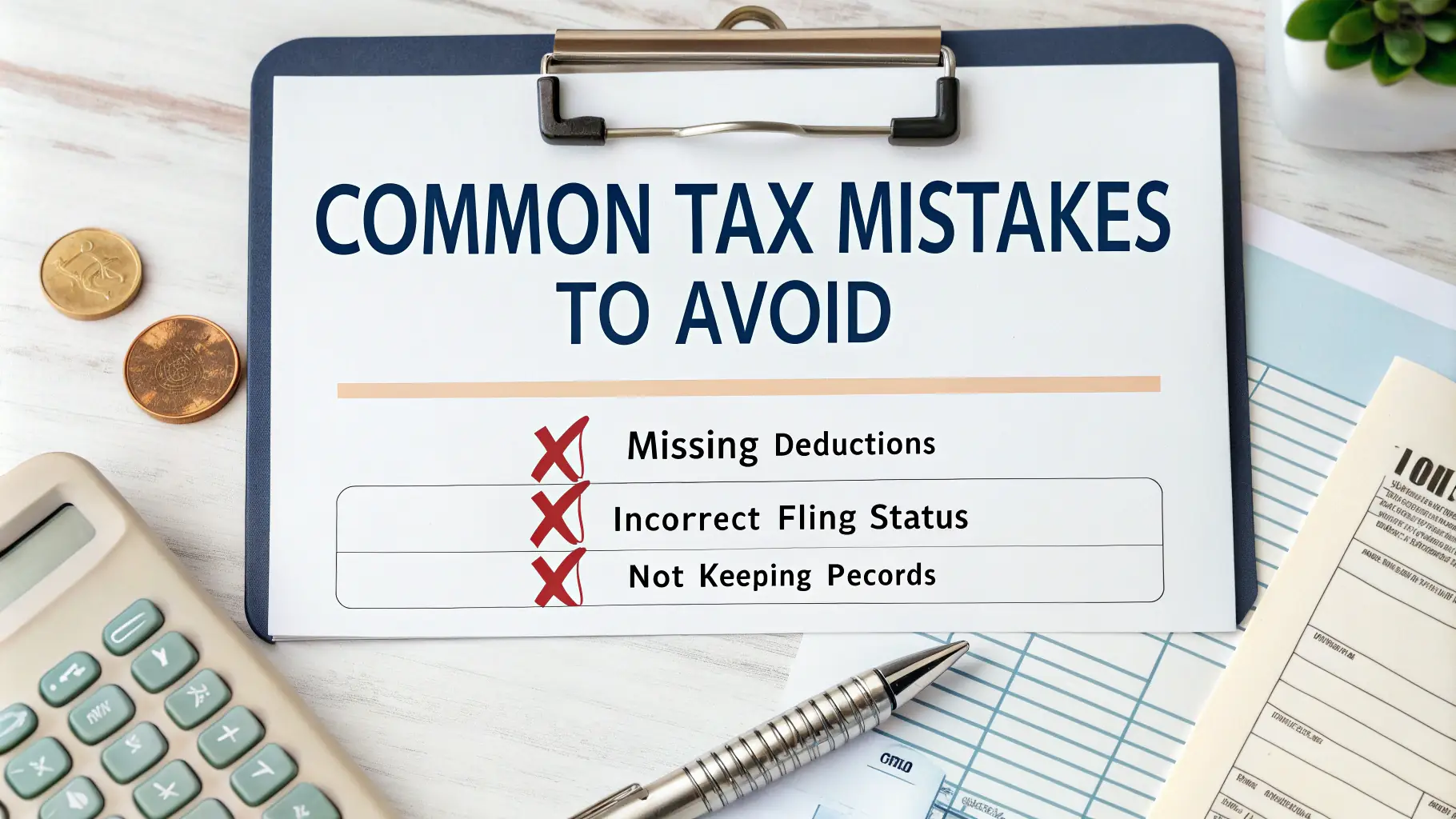

Many taxpayers overlook deductions that they are eligible for, which can lead to paying more taxes than necessary. For instance, if you are self-employed, you can deduct business expenses such as office supplies and travel costs. Additionally, charitable contributions can also be deducted, providing a double benefit of supporting a good cause while reducing your tax burden. Keeping detailed records of your expenses throughout the year is crucial for maximizing your deductions.

At TrueTax Advisors, we specialize in helping clients navigate the complexities of tax deductions. Our team of experts can provide personalized advice tailored to your financial situation. By working with us, you can ensure that you are taking full advantage of all available deductions, ultimately leading to a more favorable tax outcome.