Expert for You

Meet TrueTax Advisors

Our dedicated team includes seasoned professionals who are passionate about helping you achieve your tax goals.

Explore Our Comprehensive Tax Services

Professional Tax Preparation Services

Strategic Tax Consulting

Expert IRS Representation

Discover the TrueTax Advantage for Your Tax Needs

Expert Guidance

Timely Filing

What Our Clients Say

FAQs

You will typically need W-2s, 1099s, and any other income statements, along with receipts for deductions.

We provide expert guidance on tax preparation, planning, and compliance to ensure you maximize your returns.

Our IRS Representation services will assist you in navigating audits and resolving any issues with the IRS.

Need More Help?

Latest Tax Insights

Tax Planning Strategies for Small Businesses

Effective tax planning can help small businesses minimize their tax liabilities and maximize their profits.

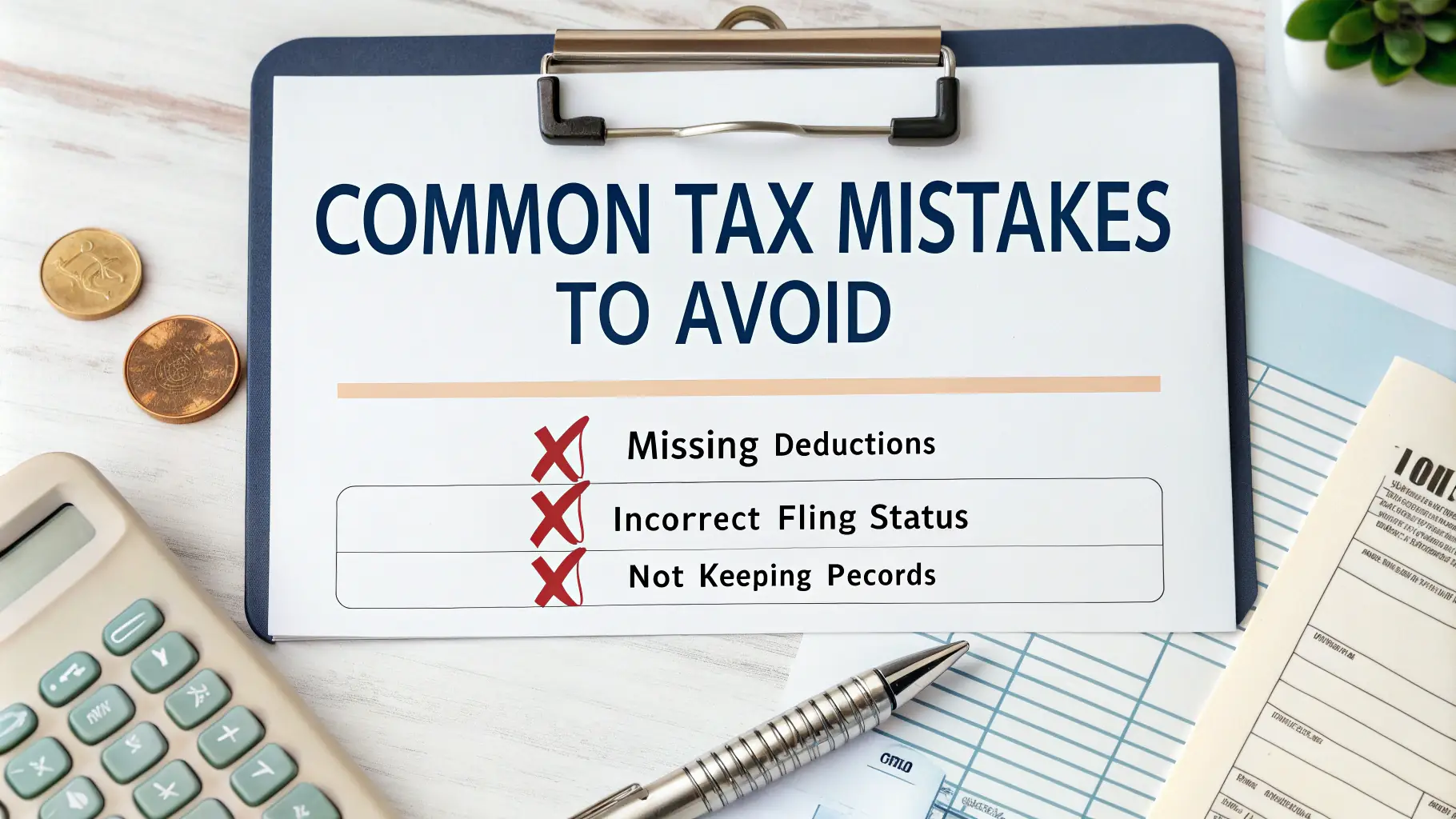

Common Tax Mistakes to Avoid

Avoiding common tax mistakes can save you time, money, and stress during tax season.

The Importance of Filing Your Taxes on Time

Filing your taxes on time is crucial to avoid penalties and ensure compliance with IRS

Understanding Tax Deductions: What You Need to Know

Tax deductions can significantly reduce your taxable income, but many people are unaware of what

Latest Tax Insights

Tax Planning Strategies for Small Businesses

Effective tax planning can help small businesses minimize their tax liabilities and maximize their profits.

Common Tax Mistakes to Avoid

Avoiding common tax mistakes can save you time, money, and stress during tax season.

The Importance of Filing Your Taxes on Time

Filing your taxes on time is crucial to avoid penalties and ensure compliance with IRS

Understanding Tax Deductions: What You Need to Know

Tax deductions can significantly reduce your taxable income, but many people are unaware of what