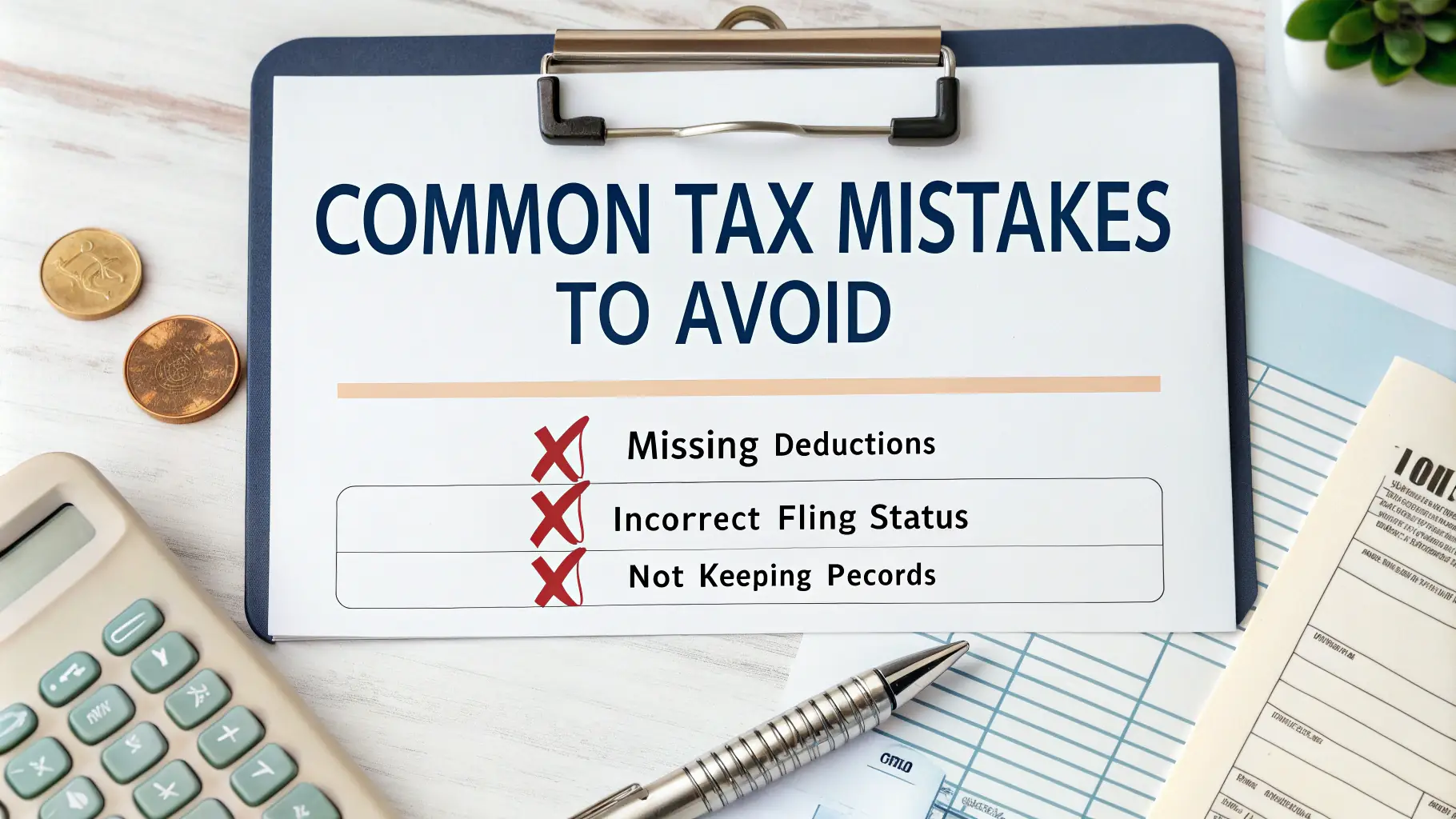

Tax planning is an essential aspect of running a successful small business. By implementing effective strategies, business owners can minimize their tax liabilities and keep more of their hard-earned profits. One common strategy is to take advantage of available deductions, such as business expenses, employee benefits, and depreciation. Understanding these deductions can significantly impact your bottom line.

Another important aspect of tax planning is choosing the right business structure. Whether you operate as a sole proprietorship, partnership, or corporation, each structure has different tax implications. Consulting with a tax advisor can help you determine the best structure for your business needs, ensuring that you are not overpaying on taxes. Additionally, regular reviews of your financial situation can help identify opportunities for tax savings.

At TrueTax Advisors, we specialize in tax planning for small businesses. Our team of experts can work with you to develop a customized tax strategy that aligns with your business goals. By proactively managing your tax obligations, you can focus on growing your business while minimizing your tax burden.